Time to Read – 2 Minutes

Hey there, financial planner! Your debt-to-income ratio (DTI) is a crucial factor in your financial health and your ability to secure loans and credit. Here’s why managing your DTI is important and how to keep it in check.

What is Debt-to-Income Ratio?

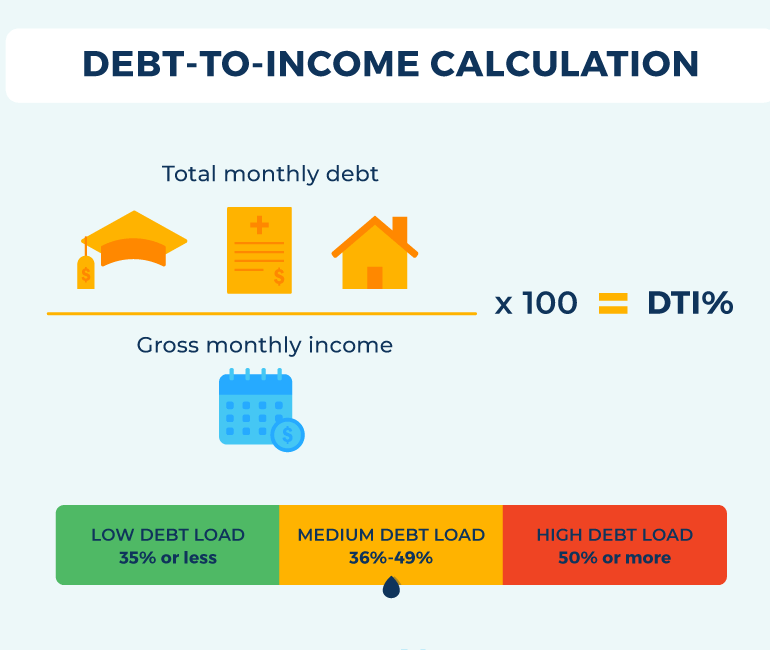

Your debt-to-income ratio (DTI) is the percentage of your monthly income that goes toward paying your debt. It’s calculated by dividing your total monthly debt payments by your gross monthly income, which includes all sources of income before taxes and other deductions.

Lenders use this ratio to assess your ability to manage monthly payments and repay borrowed money, making it a crucial factor in determining your creditworthiness.

It’s like a fitness test for your finances—how strong are you? A lower DTI indicates that you have a healthy balance between debt and income, suggesting that you have enough financial flexibility to handle unexpected expenses and maintain your lifestyle. Conversely, a high DTI can signal potential difficulties in making payments, which may lead lenders to view you as a riskier borrower.

Understanding your DTI is essential, not just for securing loans but also for maintaining overall financial health. Regularly monitoring this ratio can help you make informed decisions regarding budgeting, spending, and saving. If your DTI is higher than the recommended threshold—typically around 36%—it may be wise to consider strategies to reduce your debt or increase your income. This might involve consolidating loans, negotiating lower interest rates, or even seeking additional employment opportunities.

By taking proactive steps to improve your DTI, you can enhance your financial stability and open doors to better loan terms, lower interest rates, and a more secure financial future. In essence, your DTI serves as a vital indicator of your financial fitness, guiding you toward smarter financial choices and ultimately, a healthier economic life.

Why DTI Matters

A lower DTI indicates a good balance between debt and income. Lenders prefer lower ratios because it suggests you’re less likely to have trouble making monthly payments. A high DTI, on the other hand, can signal that you’re overextended and may struggle to meet financial obligations. It’s like having a high BMI—signals potential issues.

How to Calculate Your DTI

- Add Up Monthly Debt Payments: Include mortgage/rent, credit card payments, auto loans, student loans, and any other debt payments.

- Divide by Gross Monthly Income: Your gross monthly income is your total income before taxes and other deductions.

- Multiply by 100: This gives you your DTI percentage.

Tips for Managing Your DTI

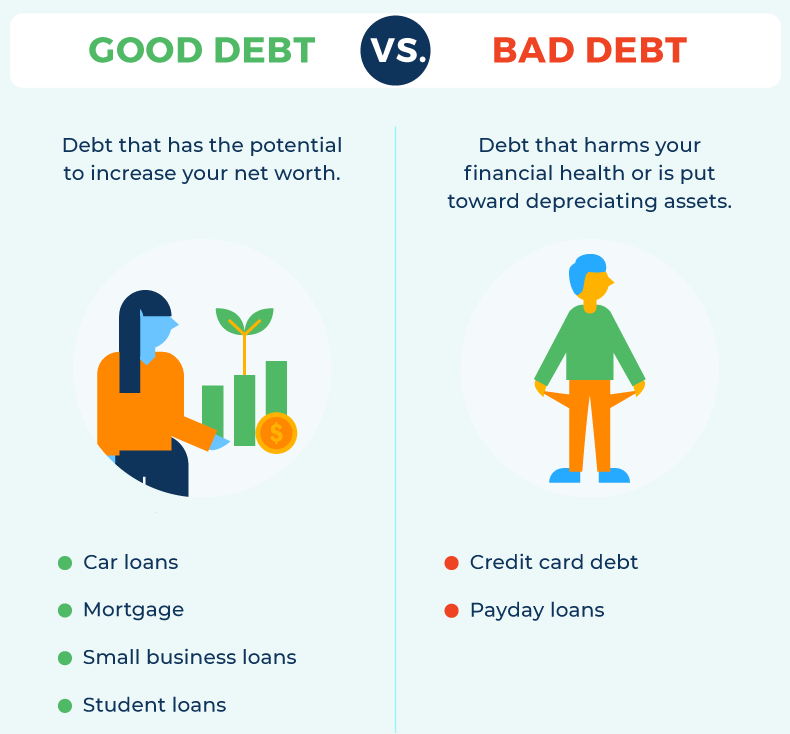

1. Pay Down Existing Debt Focus on paying down high-interest debt first, such as credit cards. Making extra payments can help reduce your debt faster. It’s like shedding extra pounds—lighten the load.

2. Increase Your Income Look for ways to boost your income, such as taking on a side job or freelancing. Increasing your income can help lower your DTI. It’s like adding muscle—strengthen your financial position.

3. Avoid Taking on New Debt Until you’ve lowered your DTI, avoid taking on new debt. This includes applying for new credit cards or loans. It’s like avoiding junk food—stick to healthy choices.

4. Refinance High-Interest Debt Consider refinancing high-interest debt to lower interest rates and reduce monthly payments. This can make your debt more manageable. It’s like finding a more efficient workout—maximize your efforts.

5. Create a Budget Establish a budget to track your income and expenses. This helps you stay on top of your finances and identify areas where you can cut costs. It’s like meal planning—stay disciplined and organized.

6. Seek Professional Help If your DTI is high and you’re struggling to manage it, consider seeking help from a financial advisor or credit counselor. They can provide personalized advice and strategies. It’s like hiring a personal trainer—expert guidance makes a difference.

Benefits of a Low DTI

1. Better Loan Approval Odds Lenders are more likely to approve you for loans and credit if you have a low DTI. It shows you can manage your debt responsibly. It’s like having a clean bill of health—attractive to lenders.

2. Lower Interest Rates A low DTI can help you qualify for lower interest rates on loans and credit cards. This saves you money over time. It’s like getting a discount—better terms, lower costs.

3. Financial Flexibility Managing your DTI gives you more financial flexibility. You’ll have more disposable income and be better prepared for emergencies. It’s like being in good shape—more energy and resilience.

4. Reduced Stress A lower DTI can reduce financial stress. You’ll feel more in control of your finances and confident in your ability to meet financial obligations. It’s like finding balance—calm and steady.

The Bottom Line

Managing your debt-to-income ratio is crucial for financial health and loan approval. Calculate your DTI, pay down existing debt, increase your income, avoid new debt, refinance high-interest debt, create a budget, and seek professional help if needed.

So, keep your DTI in check and strengthen your financial position. Your creditworthiness (and your peace of mind) will thank you!