Time to Read – 2 Minutes

Let’s talk about something that might surprise you—keeping old credit accounts open. You might think closing unused accounts is a good idea, but it can actually hurt your credit score. Here’s why those old accounts are more valuable than you might think.

Why Old Credit Accounts Matter

Your credit history length is a significant factor in your credit score. The longer your history, the better. Closing old accounts shortens your credit history and reduces your available credit, which can negatively impact your score. It’s like throwing away a vintage wine—great things get better with age.

Benefits of Keeping Old Accounts Open

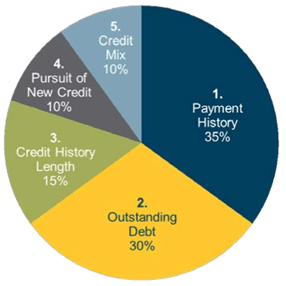

1. Longer Credit History Credit history length makes up 15% of your credit score. Keeping old accounts open shows lenders you have a long and stable credit history. It’s like having a seasoned resume—experience counts.

2. Lower Credit Utilization Your credit utilization ratio is the amount of credit you’re using compared to your total available credit. Keeping old accounts open increases your total credit limit, which can lower your utilization. It’s like having more room in your financial wardrobe—more space, less clutter.

3. Better Credit Mix A mix of credit types—credit cards, loans, mortgages—can improve your score. Keeping old credit card accounts open adds to your credit mix. It’s like having a balanced diet—variety is key.

Tips for Managing Old Accounts

1. Use Occasionally If you have old credit accounts you rarely use, make small purchases on them occasionally. Pay off the balance in full to avoid interest. It’s like dusting off old books—keep them in good condition.

2. Monitor for Fraud Keep an eye on your old accounts for any unauthorized activity. Set up alerts for unusual charges. It’s like checking the locks on your doors—better safe than sorry.

3. Avoid Annual Fees If an old account has a high annual fee, consider whether it’s worth keeping. You might want to switch to a no-fee card or negotiate with the issuer. It’s like trimming expenses without cutting corners.

The Bottom Line

Old credit accounts can be a powerful asset in maintaining a healthy credit score. They contribute to a longer credit history, lower credit utilization, and a better credit mix. Use them occasionally, monitor for fraud, and be mindful of fees.

So, next time you think about closing an old account, remember its hidden value. Keep it open, and let your credit score reap the benefits!