Time to Read – 7 Minutes

If you’re feeling overwhelmed by high-interest debt and struggling to keep up with payments, a Debt Management Plan (DMP) might be your ticket to financial freedom. Here’s how DMPs work and why they could be the solution you’ve been looking for.

What is a Debt Management Plan?

A Debt Management Plan (DMP) is a comprehensive program offered by The Barziki Group and other credit repair agencies, specifically designed to assist individuals in systematically paying off their debts in a structured and manageable way. Under this arrangement, you make a single monthly payment to the agency, which then takes on the responsibility of distributing these funds to your various creditors, simplifying your financial obligations.

The agency acts as an intermediary, negotiating on your behalf with creditors to secure more favorable terms, such as lowering interest rates and waiving late fees. This proactive approach not only helps reduce the overall cost of your debt but also alleviates some of the stress and anxiety that comes with managing multiple payments and due dates.

Enrolling in a DMP can feel akin to having a personal trainer for your finances—providing essential guidance, structure, and unwavering support as you work towards financial freedom. Just as a fitness trainer develops a tailored workout plan to help you achieve your physical health goals, a credit counseling agency crafts a personalized strategy to address your unique financial situation. This includes budgeting assistance, educational resources, and ongoing support to ensure that you remain on track and motivated throughout the process.

Furthermore, participating in a DMP can have additional benefits, such as improving your credit score over time, as you consistently make your agreed-upon payments and demonstrate your commitment to resolving your debts.

Many individuals find that the structured nature of a DMP not only helps them regain control over their finances but also fosters a sense of empowerment and achievement as they witness their debt decrease steadily.

The ultimate goal of a Debt Management Plan is to guide you towards a debt-free life, offering not just a way to pay off what you owe, but also imparting valuable financial literacy skills that can help you avoid similar pitfalls in the future. By choosing to engage in a DMP, you are taking a significant step towards reclaiming your financial well-being and securing a brighter, more stable financial future.

Benefits of a Debt Management Plan

1. Lower Interest Rates One of the biggest advantages of a DMP is the ability to lower your interest rates. Credit counseling agencies negotiate with your creditors to reduce interest rates, which means more of your payment goes toward the principal balance. It’s like getting a discount on your debt—less interest, more progress.

2. Single Monthly Payment Instead of juggling multiple payments with different due dates, you make one consolidated payment to the credit counseling agency. They take care of distributing the funds to your creditors. It’s like decluttering your financial life—simpler and more manageable.

3. Waived Fees Credit counseling agencies often negotiate to have late fees and other penalties waived. This can save you money and help you pay off your debt faster. It’s like getting a fresh start—fewer obstacles, smoother path.

4. Budgeting Assistance As part of the DMP, credit counselors help you create a realistic budget. This ensures you can make your monthly payment while still covering your other expenses. It’s like having a financial coach—practical advice and personalized support.

5. Avoid Bankruptcy A DMP can provide an alternative to bankruptcy. By creating a structured plan to pay off your debt, you can avoid the long-term consequences of bankruptcy. It’s like finding a lifeboat when you’re sinking—hope and a way out.

How to Enroll in a Debt Management Plan

1. Find a Reputable Credit Counseling Agency Look for a non-profit agency accredited by organizations like the National Foundation for Credit Counseling (NFCC). Check their reviews and ensure they have a good reputation. It’s like choosing a doctor—look for trust and expertise.

2. Schedule a Consultation Contact the agency to schedule a consultation. During this session, you’ll discuss your financial situation and goals. It’s like an initial assessment—get the lay of the land.

3. Review Your Options The credit counselor will review your debts, income, and expenses to determine if a DMP is right for you. They’ll explain how the plan works and what to expect. It’s like getting a diagnosis—understand your situation and your options.

4. Enroll in the Plan If you decide to proceed, you’ll enroll in the DMP. The agency will negotiate with your creditors and set up your monthly payment. It’s like starting a new treatment plan—commitment and action.

5. Stick to the Plan Make your monthly payments on time and follow your budget. Regularly check in with your credit counselor for support and guidance. It’s like following a workout routine—consistency leads to success.

Debt Management Strategies

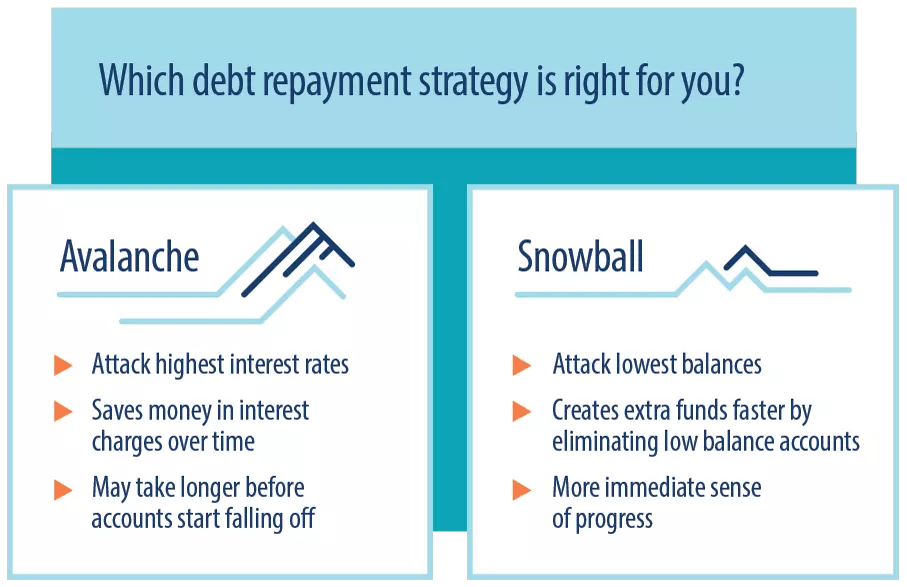

Avalanche

Avalanche Method – Is a debt repayment strategy that focuses on paying off debts with the highest interest rates first, regardless of the balance. By tackling high-interests debt first, this method minimizes the total amount of interest paid over time and accelerates debt freedom.

How the Avalanche Method Works:

- Lists Your Debts

- Organize all debts, such as credit cards, loans, or medical bills.

- Sort them from highest interest rate to the lowest interest rate.

- Make the Minimum Payments

- Pay the minimum on all debts to stay current and avoid late fees.

- See if you can get your payments deferred through your loan provider.

- Focus on the Highest Interest Debt

- Direct any extra money toward the debt with the highest interest rate while continuing minimum payments on the others.

- Repeat the Process

- Once the first debt is paid off, move to the next highest interest debt and repeat until all debts are cleared.

Snowball

Snowball Method – A method that focuses on paying off debts from the smallest balance to the largest balance, regardless of the interest rate. This approach builds the motivation and momentum needed as smaller debts are quickly eliminated, encouraging individuals to stick to their repayment plan.

How the snowball method works:

- List Your Debts

- Organize all debts, such as credit cards, loans, or medical bills.

- Sort them from the smallest balance to the largest balance.

- Make the Minimum Payments

- Pay the minimum on all debts to stay current and avoid late fees.

- See if you can get your payments deferred through your loan provider.

- Focus on the Smallest Debt

- Direct any extra money towards the smallest balance while continuing minimum payments on others.

- Celebrate Each Win

- Once the smallest debt is paid off, move to the next smallest balance and repeat until all debts are cleared.

Whatever You Choose

Regardless of the method that you choose in order to tackle your debt it’s important to follow these general guidelines.

- Create a clear debt inventory, list all the debts you have, make sure to check your credit report for free using Free Credit Report.

- Use a spreadsheet, debt tracker app, or even a pen and paper to track your debt.

- Budget aggressively in order to have extra funds to contribute to either method.

- Allocate extra money like tax returns, bonuses, or side-hustle income towards the debt.

- Cut unnecessary expenses, think subscriptions, dining out, brand names, delivery subscriptions, etc.. (A little sacrifice can go a long way)

- Stay consistent with the minimum payments in order to avoid late fees, penalties, or credit score damage. (Consistency is the key here)

- Avoid adding new debt, live within your means, use cash or debit cards, and start building a cash reserve in order to stop reliance on credit cards.

- Celebrate Milestones, whether paying off a small balance or eliminating high interest debt, reward yourself with one of the things you may have sacrificed.

The Bottom Line

A Debt Management Plan can help you pay off high-interest debt, lower your interest rates, simplify your payments, waive fees, provide budgeting assistance, and avoid bankruptcy. At Barziki Group, we tailor a Debt Management Plan for your specific needs and recommend which actions to take. We also negotiate on your behalf to see if we can get existing debts lowered or removed all together. So, take control of your debt with a DMP from Barziki Group. Your financial freedom (and peace of mind) will thank you!